HOW DOES SHE DO IT? OUR ECONOMY OF BS AND SINECURES

The Bright Heavens of the Past

I recently finished the excellent trilogy Pax Britannica written by the late James Morris (later to become Jan Morris, but that’s another story). It is a rather thorough and compelling history of the Victorian Empire from its rise following the loss of the American colonies, to its 20th-century dissolution into a meaningless “commonwealth of nations.”

Morris is a talented writer and the whole thing is written in the lyrical and rather elegiac tone of one who had grown up as a man in the waning days of Empire and died a woman in the days of its complete demise.

One of the deepest sighs of “Oh, I can’t believe we’ve lost all of that!” is in response to the manly and expansive might of the Victorians. Theirs was an economy of perpetual expansion – of gigantic bridges, mighty dams, underwater cables, ever-busy shipyards, ocean-binding canals, and steaming railroads.

The frontiers, like in America of the same period, were endless. Not a year would pass without a new wondrous territory opening up for commerce and investment and of course the occasional fighting for it.

Needless to assert, our economy of cheap credit, vapid transactional activity, and idiotic smartphone “apps” is nothing like that. Unlike Victorian hydrologists building dams and redirecting rivers, we have management consultants, media specialists, HR ladies, and legions of government employees (who now on average are better paid than private sector employees).

Beloitte and the BS Economy

How is it possible? Shouldn’t so much uselessness collapse and implode? Shouldn’t the market punish misallocated resources by writing them off as a loss? Well, not exactly. Here’s my cursory theory of bullshit.

Ultimately, we now have an economy where almost all well-paying jobs are a form of sinecure (coming from that Latin sine cura, without care or toil). Many industries have ring-fenced themselves from the powers of the market by moats of regulation, grift, and lobbying. Let me provide an example.

Previously, I was an employee of several marquee consulting firms, let’s say one of them was Beloitte. Presumably, Beloitte makes money by offering companies very good advice, thus allowing them to outdo the competition, which then generates more money for those companies, and consulting fees for Beloitte.

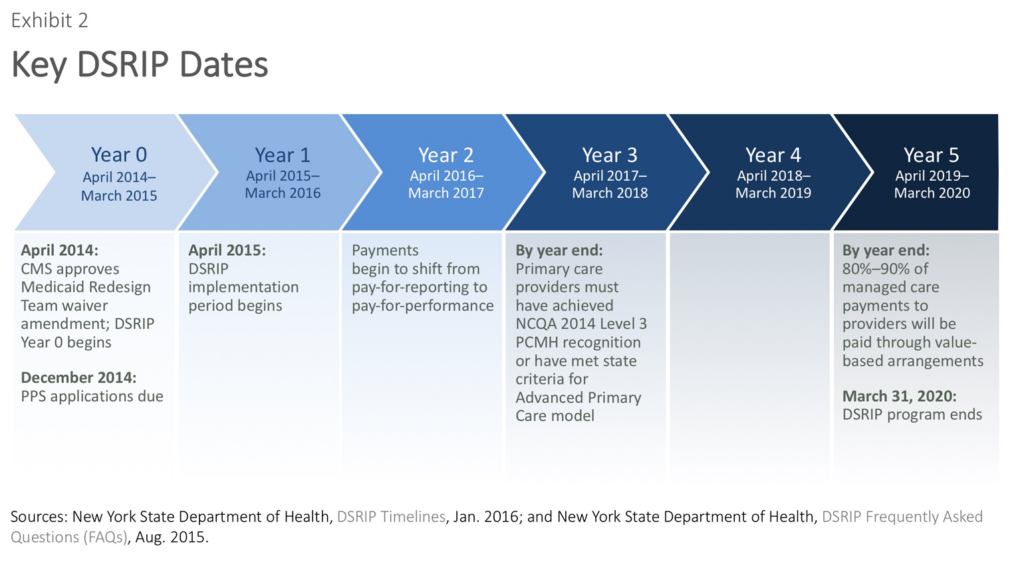

However, that is not exactly the case. Here’s the promised example: Back in the day, the State of New York decided to spend $7.4B on a nebulous re-design of its Medicaid services. It had a stupid acronym, feel free to look it up.

New York’s health authorities, being as they were the locus of diversity hires and much incompetence, had no idea what to do with a sudden gift of $7.4B, so they hired the likes of Beloitte. Those were fun times -Imagine an endless rain of PowerPoint presentations, many well-ironed suits, lots of to-go cups, meetings running into the night, anxious partners (all very important!), and eager little consultants. Eventually, some plan was hashed out: The billions would be given to weird new organizations, that now had to be created from scratch, representing collaboratives of hospitals and clinics (in industry jargon they are often called “ACOs,” accountable care organizations, whatever).

So guess what? Somebody had to implement the 5-year plan. Beloitte! Think chunks of 8 hours per day per consultant charged unchecked by legions of eager fools hauling themselves back and forth every week to NYC to serve as government bureaucrats by extension. Many new boats and summer houses for the partners!

But that’s actually the less ugly half of it. Remember those “ACOs?” They had to be created. And so each of them was hiring – directors, analysts, board members, strategy officers, IT specialists, HR personnel. Each was a new company filled with great, presumably private jobs. The data analyst of the “Hudson Valley ACO” or whatever probably thought of himself as having a private sector job with all the flashy emblems of seasonal pumpkin lattes, a nice wristwatch, and employee appreciation days.

Yet there was nothing “private” about it. It was a sinecure. Both “private” Beloitte and the “private” ACOs were simply leeching off of a market CREATED by government fiat, through a decision to force things in a specific way, and through the pumping of billions of dollars into that fiat market.

Needless to say, each ACO-creature was also supported by consultants (some from Beloitte!), accountants, attorneys, IT vendors, and that sort of thing. All presumably “private,” yet propped up by an artificial sinecure.

“Can Heav’n Permit Such Crimes to Be Attended with Felicity?”

Apparently so. Look around you and examine large companies and businesses through the lens I have just provided you. All accountants, clearly, are the beneficiaries of a sinecure created by government complexity; many attorneys too; the universities clearly all depend on grants and government largesse; finance jobs, whatever they mean, feed off of a market of cheap credit, created by government policy, and engage in empty transactions.

The overly busy lady on her phone grabbing a high-priced sandwich at Pret may seem like a feminist success story! How does she do it? But most likely she’s not a mining engineer, but a vapid director of corporate communications imposing government-mandated rules and verbal pieties.

The extent of these sinecures is so large, that even companies presumably operating in a non-sinecure market, say – furniture makers, are polluted by this – they provide furniture to businesses who are themselves sinecures.

Also, many businesses are hybrid creatures. They receive a little grant here, apply for a special program there, but at the same time also retain a business. So we end up with a spectrum: On the one end of it you have absolute sinecures (government employees) and on the other end you have completely private businesses (say, a scuba-diving instructor). But in between, you have a host of ugly hybrids and chimeras like Beloitte, the ACOs, vapid financial firms, corporate accountants, and much general uselessness.

Can Heaven permit this to go on forever? Probably not, at the end of the day, this is all financed by debt and made possible by low growth. In a high-growth environment, many businesses would simply rush forward to the next planet to settle, and build spaceships, great engines, and domed cities. None of them would bother with meaningless subsidies from the State of NY. But these are not space-Victorian times. Not yet.

Follow us on Twitter!

And sign up for updates here!